Us hourly wage tax calculator 2020

See how your withholding affects your refund take-home pay or tax due. If youre starting a new small.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Injury and Illness Calculator.

. First enter your Gross Salary amount where shown. Using the United States Tax Calculator is fairly simple. Enter up to six different hourly rates to estimate after-tax wages for.

Next divide this number from the. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Payroll So Easy You Can Set It Up Run It Yourself. Median household income in 2020 was 67340. The state tax year is also 12 months but it differs from state to state.

United States Department of Labor. This places US on the 4th place out of 72 countries in the. An official website of the United States Government.

See where that hard-earned money goes - with Federal Income Tax Social Security and other. Publication 505 Tax Withholding. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

Select your age range from the options displayed. Next select the Filing Status drop down menu and choose which option applies. How do I calculate hourly rate.

Some states follow the federal tax. Enter the hourly rate in the Hourly Wage box and the number of hours worked each week into the Weekly Hours box. The average monthly net salary in the United States is around 2 730 USD with a minimum income of 1 120 USD per month.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. For 2022 Wyoming unemployment insurance rates range from 009 to 85 with a taxable wage base of up to 2770000 per employee per year.

How Income Taxes Are Calculated First we. This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Taxes Paid Filed - 100 Guarantee. Discover Helpful Information And Resources On Taxes From AARP. Find out the benefit.

Taxes Paid Filed - 100 Guarantee. An official website of the United States government Here is how you know. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

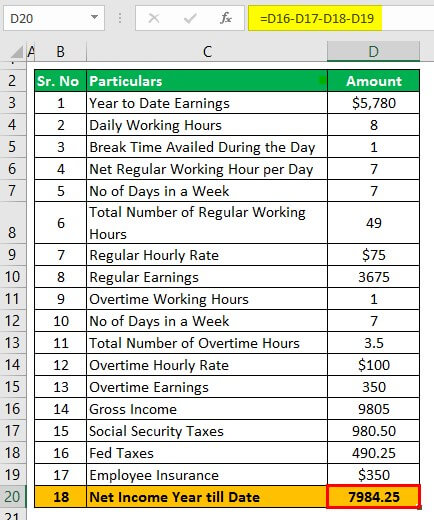

Hourly Paycheck Calculator Step By Step With Examples

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Paycheck Calculator Online For Per Pay Period Create W 4

Paycheck Calculator Take Home Pay Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Paycheck Calculator Take Home Pay Calculator

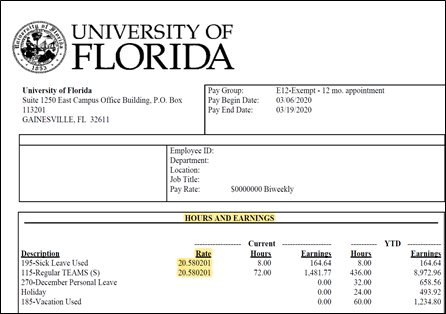

Efmlea Single Day Efm Calculator Uf Human Resources

Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions Free Amazon Com Appstore For Android

How To Calculate Payroll Taxes Methods Examples More

Usa Tax Calculators Amazon Com Appstore For Android

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Free Paycheck Calculator Hourly Salary Usa Dremployee

Usa Tax Calculators Amazon Com Appstore For Android

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp